Well well well,

what have we got here? 🤔 Facebook just announced Libra or as NPR’s Planet Money calls it ‘Facebucks’. But what is this ‘cryptocurrency’ that the who-is-who of Silicon Valley unicorns 🦄 have signed up to support? Spoiler alert… it’s not a blockchain:

There is no concept of a block of transactions in the ledger history — Libra’s technical paper.

But who cares whether it’s technically a blockchain or not, as long as it’s permissioned it might as well be a MySQL database that’s updated with a voting system written in PHP for all i care.

Don’t get me wrong, I don’t hold a Bitcoin maximalist perspective, I’m quite value neutral with respect to the project, even a bit optimistic. I’m personally most interested in getting to the economic substance of the project, the product implications and the effects on the wider crypto ecosystem.

In this post I’m describing a novel perspective on Libra, which is somewhat different from what you’ll find in most mainstream media outlets. Expect maybe the Financial Times, most have either bought into the ‘crypto narrative’ or have made this another episode of FB privacy rants. Meanwhile, no one has actually looked at why this is actually a genius idea from the side of Facebook’s balance sheet… So my ‘theory’ involves:

- An understanding of Libra as a massive money market fund that puts Facebook’s $40bn+ idle cash reserves to productive use and at the same time gives Facebook a huge inflow of interest-bearing liquidity to manage (notably, interest it doesn’t have to pass on to depositors!).

- The Libra challenges or forces us to revisit Joel Monégro’s ‘fat protocol theory’ in crypto that has come to dominate our thinking on where value is created in crypto (protocol vs. application level).

But this is obviously just one viewpoint, there are many different perspectives and theories on the substance and direction of the project:

- My first personal reaction was to ask whether this is another high-stakes stablecoin project doomed for failure after the infamous shutdown of Basis, which received $133m in funding from Andreessen Horowitz and Bain Capital Ventures and then folded in December after just 8 months due to ‘regulatory constraints’? We all know regulatory issues in crypto are real…I refer to my extensive post from last week on Kik vs. SEC. Also, the largest stablecoin by market cap, Bitfinex’s Tether, is currently famously embroiled in a regulatory carfuffle with the New York Attorney General. And sure enough regulators around the world have already jumped on Libra shortly after the announcement.

- Or is this just Facebook copying the Wechat and Alipay product features? Barclays equity analyst Ross Sandler has suggested that Facebook could be building out the ‘Wechat of the West’, going for emerging market remittances at a $19bn revenue potential.

- Or is this every HODLers hopes and dreams coming true and we are now really at the dawn of Friedrich Hayek’s Denationalization of Money? With Libra being the ‘gateway coin’ for the rest of the pack?

- Or, last theory, is this, as the Financial Times puts it, just “a glorified exchange traded fund (ETF) which uses blockchain buzzwords to neutralise the regulatory impact of coming to market without a licence.”

As I mentioned already, looking at the financial architecture of the project, the Libra project does in my opinion look much more like a massive money market fund with a sophisticated API than a crypto project.

Notably, a money market fund that doesn’t pay any interest to ‘investors’ or coinholders (to be fair, this is certainly in part to avoid being qualified as a security by the SEC under the Howey Test 👨🏻🌾🍋). It does, however, pay this interest to its sponsors, the Libra Association members, who are managing the float. And as I will show in this post, the Silicon Valley sponsor consortium, and Facebook in particular, seem financially well positioned to manage this fund as they have massive idle cash reserves that give them a real edge ($40bn+ in the case of Facebook).

I’m still working through the details of Facebook’s ‘project’ myself, but here’s my current thinking. 💭👇🏻

Tl;dr

This week, Facebook revealed 📣 the much-anticipated whitepaper 🗒 and the technical document (written by no less than 53 authors !) for its ‘cryptocurrency’ Libra ≋ that it’s planning to launch in 2020. 🚀

It’s a proof-of-stake (PoS) 🤚 stablecoin ⚖️ with a new byzantine-fault-tolerant consensus algorithm (LibraBFT) that will be pegged to and collateralized by a basket of fiat currencies ($,€,¥,£). Libra ≋ is technically not a blockchain ⛓🤔 (at least not one in the Bitcoin tradition), even if FB keeps calling it that. Rather its a set of signed ledger states. ✍🏻 It’s still cool tho. 😎 And actually Facebucks doesn’t have to be a bitcoin-style blockchain, as it will be a permissioned chain (at least in the beginning) with big tech validator nodes (aka no 51% attack problems). 🦍

Facebook has set up an independent Geneva-based ⛰🇨🇭 association with 28 high-calibre Silicon Valley founding members 🌉, which will act as validator nodes. This consortium includes the biggest names in payments, marketplaces and venture investing, such as Stripe, Uber and Andreessen Horowitz. 💪 But….️ ️☝️no banks (so far). 🏛️❌ Apparently they asked Goldman and JPMorgan to join the party 🎉, but they already have their own crypto/payments projects (Quorum-based JPM Coin and the Apple Card). Apple 🍎 and Alphabet 🔭 are also not part of the pack (yet). They have $65bn+ and $100bn+ respectively sitting on their balance sheets so they can run their own bank if they want to (aka Apple Pay and Google Pay).

The 28 members each put in at least $10m to seed-fund the foundation and to get a vote. 🗣 While certainly a primus inter pares 🥇, Facebook will nominally have only one vote 🎟 like all the others. And they are looking for more corporate, university and NGO members. 🔍 In the first stage they want to recruit up to 100 nodes (everyone can apply…as long as they have a 100Mbps internet connection 🔌 and a $1bn market valuation 🦄). Over time, Facebook plans for Libra to transition from a permissoned to a permissionless blockchain (we’ll see about that… last time I checked, king Vitalik 🤴🏼wasn’t ready with his PoS system yet either).

If successful, Libra could imho become the first mass adoption internet ‘currency’ 💰💻 that is both a store of value 🔑 and an effective means of exchange 🤝. The Libra ≋ association would then effectively become a giant global money market fund 🌎 some even say the ‘internet’s central bank’, which would operate massive currency reserves — managing kazillions in government and corporate bonds.

What the internet had to say about it

First things first: let’s look at other people’s opinions first, because that’s how one is supposed to form an independent opinion (jk, don’t be a sheep 🐑).

Let’s start off with the cheerleaders. 🙆🏻♂️ Garry Tan from Initialized Capital, along with lots of people from crypto twitter, basically reckoned that Libra could become an on-ramp for other forms of programmable money. I call this the ‘gateway coin argument’.

Yeah…maybe that’s right and Libra becomes the ‘dollar of the internet’ that others can then peg themselves to. But maybe the power of this stablecoin lies in the fact that it has mass adoption in the application layer and this is just enough for the payments use case (see my thoughts on the end of the fat protocol theory at the end of this post👇🏻).

On the opposite side of the spectrum, there was of course the privacy and cypherpunk crowd:

Sure, we could turn this into another rant about big tech. But let’s face it, the most successful decentralized application so far, Ethereum’s ERC-20, hasn’t exactly encouraged the rise of the most ethical organizations either. Trust has indeed become the rarest commodity in the trustless consensus space. Don’t troll me for this, early adopter/builder in the space speaking! But if we look at the statistics on Dapp Radar, it’s far from mass adoption and the most heavily used applications are still speculation, gambling and maybe collectibles. Far from the many use cases that were promised by projects with record funding levels. It’s kind of sad, but that’s just how it is: the marketing wrote a cheque that the tech couldn’t cash (yet).

So I think even from a cypherpunk’s perspective, one should be excited (or at least appreciate the irony) that Facebook is running crypto ads again, this time for their own ICO.

Then we had of course the bitcoin maximalists speaking out:

People say they don’t trust Facebook…but let’s be real here: people trust Facebook a whole lot more than they trust most crypto projects.

Facebook is for sure polarizing, but even if the variance has increased, the mean still doesn’t care.

I personally think the most useful comments came from people who didn’t make this another episode of Facebook bashing, but tried to tease out what the long game is that Facebook is playing here:

Andreas is spot on with this tweet I think: In my opinion this is not Facebook competing against other stablecoins (such as Maker Dao’s DAI, Bitfinex’s Tether or TrustToken’s TrueUSD) or messenger tokens (Kik’s Kin or Telegram’s gram), but this is Facebook and Silicon Valley coming for Wallstreet with a massive proprietary money market fund that allows them to park their excess liquidity and at the same time eat into the payments processing value chain.

A lot of people on Twitter have compared the ‘Libra Reserves’ (which are basically the real asset collateral escrowed by the Libra Association) to central banks’ Special Drawing Rights (SDRs). The Financial Times spoke out against this comparison (in what was more of a general critique against the Libra project itself). I also don’t think the SDR comparison holds. Angel investor Parker Thompson has made a comparison to the Berkshire/Geico model, which I personally find a much better analogy.

If you’re not familiar with the Berkshire/Geico model, aka ‘how Warren Buffet became the richest person in the world’, have a look at this piece, where it says in part:

‘insurance float is essentially like a $91.6 billion interest-free loan that Berkshire is actually being paid to take’

In my opinion, if you look at the draft financial structure of the Libra, this is exactly what Libra could become…Users of Libra essentially provide the Libra consortium with interest-free loans, which the Libra Association can then invest in government and corporate bonds at a large scale. More on the mechanics further below.

Who’s behind this thing at Facebook?

But let’s start from the very beginning. The year was 2017, ICOs were just ramping up to what would become ‘the money grab of the century’. The spring air was fizzling with appetite for crypto. 🤤 What was billion dollar Facebook up to on the blockchain block? Actually, not very much it seems. As Wired Magazine described it last year:

‘Facebook had tasked a lone corporate development staffer — Morgan Beller — with looking into the subject’

This is Morgan Beller all the way back in 2012, while still in college, talking passionately about the ‘vicious cycle’ of Facebook selling data to advertisers. 😇

Just four years after graduation from Cornell with a Bachelor’s in Statistical Informatics, stints at eBay, Andreessen Horowitz and Medium, she was tasked with the monumental task of turning Facebook from a databank into a Facebucks bank.

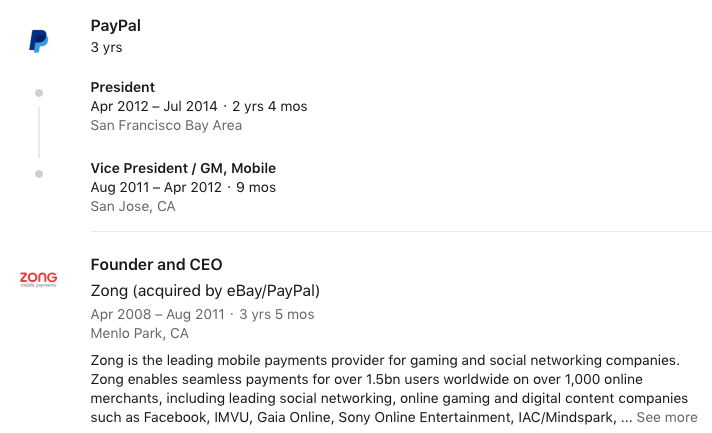

But she wasn’t working on this project on her own for very long. She would soon be joined by senior mobile/messenger payments entrepreneur, turned big tech VP, David Marcus.

Originally from Geneva Switzerland 🇨🇭, seems like a good fit for this role. He has worked on the narrow problem set of social payment solutions for more than a decade already (not really the ‘management of a billion dollar money market fund’ bit, but that’s the Libra Association’s job now anyway). He originally joined Facebook in 2014 from PayPal, which had bought his mobile messenger payments company Zong in 2011.

For the first 4 years he worked on mobile messaging, but in late 2017 he got excited about crypto, joined the Coinbase board and soon thereafter his job title at Facebook was morphed into “Exploring Blockchain”.

Fast forward to today, David Marcus is the face of Libra, publicly announcing and discussing it on CNBC last week.

The Libra foundation is also set up in his hometown Geneva, where he studied economics for a year at the University of Geneva in the 1990ies before dropping out to work at …a bank.

How does this thing actually work? 🤷🏼♂️

So a simple, version of understanding how this Libra thingy will work, and why this makes sense from an economic perspective probably goes something like this:

Facebook has formed a Swiss foundation with a bunch of its unicorn friends 🦄 from the Valley. This is non-profit, but that doesn’t mean that there will not be any profits. Quite to the contrary: when you buy Libra for fiat, you trust that the Libra Association will put your hard-earned fiat under some safe mattresses. 🛌 Of course, that’s not what they do… instead they go to the market and buy themselves some interest-bearing assets. 📈 Unlike in a bank account, where you at least get a few bps on your checking account, Libra deposits pay no interest at all. Say..whaaat? Well, that’s in part thanks to our good old citrus farmer, aka the Howey test 👨🏻🌾🍋. The interest on these assets instead goes fully to the Libra Investment Token (LIT) holders. That makes this literally a LIT business model. 🤑

Of course, you can redeem your Libras for fiat at any point in time. In a scenario where everyone wants to cash out at the same time, this would (theoretically) mean that the interest-bearing assets would have to be liquidated in a fire sale. 🔥 But this is where the massive cash reserves of Facebook will come into play (more on this later).

But let’s first dig a little deeper into the system architecture and explore how this differs from other Stablecoin projects and why the Libra ‘blockchain’ (which isn’t actually a blockchain) might as well be some gimmicky database layer on top of the escrowed assets.

Two-token system

It is customary for Stablecoins to have two and sometimes multiple tokens.

Basis, for example, had three tokens: the basis token, the bond token and the share token (I refer to Katherine Wu on why you should never, ever call your share tokens a ‘share’ token 🤦♂️ even if that’s exactly what they are).

Libra has gone with the two-token model, very similar to MakerDao. Remember, MakerDAO has the MKR, which is their governance token (the (share 🤐) token with upside📈 in which a16z has invested $15m) and the DAI, which is their stablecoin (which is obviously meant to be stable 🙏🏻, so no upside for holders).

Libra has the Libra Investment Token (LIT), their governance token and the their stablecoin Libra. The governance token entitles holders to a vote and provides them with juicy dividends from surplus interest on the reserve asset.

Although Facebook would never (and should never!) call it a share, the governance token LIT is very much like a share in a bank: it let’s the token holders make decisions and collect what is left over after all creditors are paid off (which could be a lot, since creditors don’t get paid any interest here 😯). The stable token is more like a zero interest bank deposit.

Dominant escrow systems in the stablecoin landscape

The whole point of a stablecoin is that it is backed by some kind of low volatility asset, in particular a fiat currency like the USD. The way to achieve this backing is either through the good old wide-eyed 🙄🙏🏻 trusting of a third party or through a sophisticated on-chain smart-contract system (that only the project originators will ever fully understand 🤓).

To understand how Libra fits into this spectrum between trust 🙏🏻 and onchain nerd-out smart contract escrows 🤓, let’s quickly recap how the crypto industry has handled this so far.

On the arguably ‘sketchier’ and ‘less sophisticated’ side of things is Tether, one of the most meme-able cryptos after Dodge. Tether is basically the issuer of a stablecoin saying ‘trust me dude, i’ve got you covered 😎🤝’.

Tether is currently the ninth-largest cryptocurrency by market cap, running on the Omni layer on top of the bitcoin blockchain. Since 2014, its issuer ‘Tether Limited’ has claimed that every Tether in circulation is backed by a dollar in the company’s bank accounts. But the company has repeatedly failed to provide a formal audit, leading many to speculate that its claims of backing were fraudulent. And indeed, it has recently turned out that it was actually not fully backed. 😜

This goes to show more generally how any off-chain escrow system will naturally always be kinda messy and trust-based. 🤕

This is the case even if you name your token “TrustToken”… TrustToken, is a stablecoin project backed by some high-prestige VCs, including a16z crypto and GGV. But it too, hasn’t been able to iterate much on the trust side either. Their solution has been to partner with an accounting firm (no, it’s not KPMG or PWC 😅, but one that no one has ever heard of, the big five don’t touch crypto projects with a ten foot pole). The accounting firm provides a live dashboard where you can check whether your fiat is still stored safely under TrustToken’s mattress. 🛏 This model is basically trading the lower reputation/trust in the issuer for the supposedly higher reputation of the accounting firm.

Then, on the other end of the sophistication spectrum 🤓, we have MakerDAO’s Collateralized Debt Position (CDP) system which is a smart contract run on the Ethereum blockchain. The way it works is that people can basically create as much Dai stablecoin in exchange for locking up their own ETH at collateral. Basically, this is people putting the money under their own mattress, but in a pretty open and verifiable way. 🛌💪

But why would you do that? Well, either you need DAI to purchase things (you probably don’t 😝) or, (and this is the way it’s been marketed to the Ether HODLers) you put it in a CDP to buy more Ether. Basically, it’s to take a leveraged position in Ether.

It’s a terribly misunderstood system imho. Some people, including MakerDAO’s VC, Chris Burniske from Placeholder, have compared this overcollateralization system to peer-to-peer loans. I think this comparison is quite misleading, as I’ve publicly stated in the past:

Nevertheless, I like the MakerDao’s CDP system a lot from a technical perspective. I think it suffers mainly from the fact that you have a high volatility asset (ETH) on the one side that you’re trying to turn into a low volatility asset (DAI). It’s like trying to turn a lion 🦁 into a turtle🐢: it might work for a while, you can cache the lion for a bit, but it’s a transformation that’s not going to stick and that’s not going to scale.

The problem is that it requires you to over-collateralize and you will basically only do this if you’re long ETH and you want to further leverage your position. Or you want to get out of ETH via DAI, which is probably not a good idea in the first place either. Long story short, I think there’s a lot of value in the logic of the MakerDao system, but that it will be very difficult to execute given the underlying high vola digital assets it relies on.

Libra’s escrow system

Now that we know what the ‘industry standard’ is…let’s see how Libra is planning to handle their own escrow system? 🤔

This is how Libra describes its plans:

The reserve will be held by a geographically distributed network of custodians with investment-grade credit rating to limit counterparty risk. Safeguarding the reserve’s assets, providing high auditability and transparency, avoiding the risks of a centralized reserve, and achieving operational efficiency are the key parameters in custody selection and design. — Libra

Given that the Libra uses a (still undefined and dynamic) basket of fiat currencies as collateral, it doesn’t come as a surprise that this will be an off-chain escrow system relying on traditional financial custodians.

If you want to compare it to existing stablecoin escrow systems, I think it will basically be the ‘TrustTokens model on steroids’. Meaning you will have some brand name, high credit escrow agents (a bank or a payment provider) providing the Libra system with credibility in the market and getting some bps in custody fees back. The escrow agents could even be a founding member of the association (e.g. Visa) and there will probably be some (private or public) API gateways to monitor the escrowed fiat funds.

It will definitely be less sophisticated/transparent than MakerDAO, but also much more scalable as an increase in Libra’s ‘money supply’ doesn’t require people to escrow their own funds in a smart contract.

Getting into the technical weeds of the consensus algorithms

The Libra has a pretty fancy consensus algorithm, named LibraBFT. It’s a variant of the HotStuff framework that was released in 2018 by Maofan Yin and Dahlia Malkhi of VMware Research.

As Binance Research notes ‘It may also allow for future interoperability with other chains powered by BFT consensus, such as Tendermint-based chains like Binance Chain’ (imho it’s not very realistic that they will actively work towards interoperability tho, sorry Binance 🤷🏼♂️).

To get up to speed with the technical side of the Libra chain, I can highly recommend Jameson Lopp’s piece, where he runs through the 26 page technical report. Here are two nuggets from his comment. The first one helps us to understand why Libra can afford to be a blockchain without using any blocks:

The purpose of putting batches of transactions into containers, or blocks, is for the purpose of ordering and time-stamping them. This is very important with permissionless networks, in which the data is authenticated via dynamic multiparty membership signatures where the validators can freely join and leave the network. Since Libra runs a permissioned system, it can use a more efficient consensus algorithm that doesn’t need to batch transactions because the transaction history is much less likely to be rewritten.

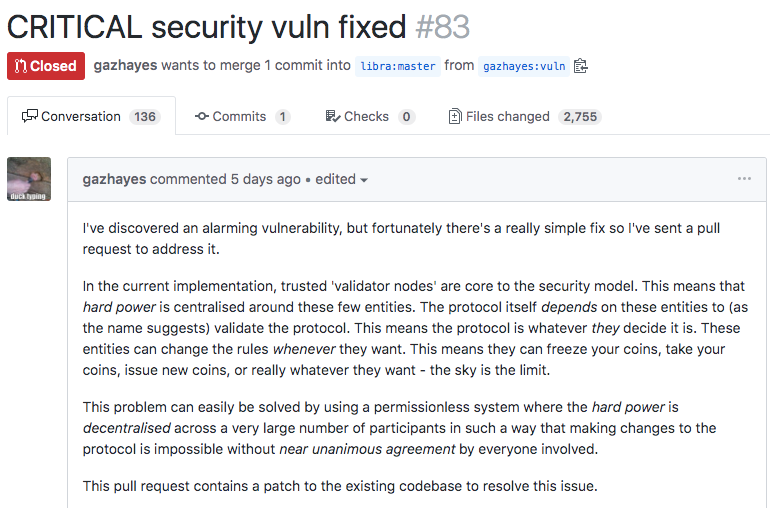

In other words, the Libra Association can run whatever signed versioning system they want, it doesn’t matter since they are a permissioned system.

If I look at the Libra consensus algorithm, I would probably most likely describe it as a ‘corporate EOS’, where the delegated proof-of-stake (DPoS) validator nodes have been selected by Facebook.

Like we know from EOS, this obviously allows for massive throughput: Libra promises 1,000 transactions per second.

The second excerpt of Jameson Lopp’s piece, helps us to understand why the offchain escrow system that we’ve described above will make the transition to a permissionless system pretty-much impossible (unless they invent a MakerDAO-style CDP system for fiat baskets):

I’m pretty sure this would be the first time a distributed network transitioned from permissioned to permissionless. Perhaps the network as a whole can switch to proof of stake, but in order for the stablecoin peg/basket to be maintained, some set of entities must keep a bridge open to the traditional financial system. This will be a persistent point of centralized control via the Libra Association.

What this boils down to is that the whole blockchain fuzz 👾 layered on top of the underlying fiat escrow system, isn’t really that important… Facebook and the Libra consortium could theoretically, at any point in time reverse transactions or fork the Libra ‘chain’ if they notice any fraudulent activity. And maybe that’s not a bad thing!? But this has nothing to do with a traditional blockchain and the point of an immutable ledger. The reason they can fork at any point and their fork will dominate, is because they will always hold the real-world legal claim to the escrowed Libra Reserves, much like Tether and TrustToken does.

The whole thing will be very much ‘walled corporate gardens’ 🌳, even if the Whitepaper is full of cypherpunk and crypto lingo. It even has it’s own programming language ‘Move’ 🤓, a smart contracts language for the Libra ‘blockchain’. According to the language whitepaper, it is an “executable bytecode language used to implement custom transactions and smart contracts”. But think of it more like a way to access Stripe’s API, than a smart contracts language… Oh, how I can’t wait to see the first LinkedIn profile’s popping up, listing “10 years of Move experience” on their CV. 🤦🏻♀️

But honestly, whatever fancy ‘blockchain’ governance system they layer on top of this: it matters a bit, but in the end it doesn’t matter that much. At least not for now, in the highly centralized/permissioned setting it’s mostly a marketing gimmick imho (question marks on whether a permissionless system will ever materialize, but kudos for letting us dream).

In the next section, I provide a more ‘common sense answer’ to why the Libra project exists, rooted in simple corporate finance and market microstructure principles. I’m hoping to describe why this system, even if the blockchain part is not key imho, still makes a lot of commercial sense from the perspective of Facebook and the other Libra partners.

Always, always, look at the balance sheet first 👀

If you want to understand what a company does and where its pain points are: always, always look at the balance sheet first!

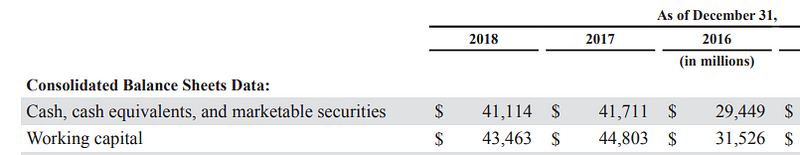

And I’ve been saying this for a while now about Facebook: with $40bn+ in cash sitting on your books, your balance sheet does not look like a high-growth tech company anymore, but much more like that of a bank. 🏛

Already in 2012, Peter Thiel gave a really candid speech about the growing cash balances at the tech giants and the management challenges that come with sitting on piles of cash. 😬💰

Returning the funds is not an option and at a certain level of consolidation, it doesn’t even make sense to use the cash as a war chest to buy out upcoming competitors (as there are none or they can be ‘crushed organically’ 🔨🤠):

‘So, you invest in Google, because you’re betting against technological innovation in search. And it’s like a bank that generates enormous cash flows every year, but you can’t issue a dividend, because the day you take that $30 billion and send it back to people you’re admitting that you’re no longer a technology company. That’s why Microsoft can’t return its money. That’s why all these companies are building up hordes of cash, because they don’t know what to do with it, but they don’t want to admit they’re no longer tech companies.’ — Peter Thiel

What does this have to do with Libra ≋ you may ask? Well, what many people don’t understand about the Libra project is that it’s essentially a huge liquidity game 💦 and a way for Facebook to very effectively park their idle cash reserves. 🚖💰

The way it is structured, the Libra users could be taking a large portion of Facebook’s cash reserves off of FB’s hands and at the same time provide Facebook with additional interest-bearing liquidity.

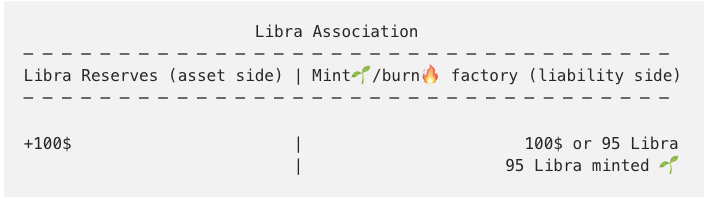

To understand how this works, we need to take a step back an look how the Libra system creates liquidity in the first place. Let’s look at a small dummy transaction, where someone puts a 100$ into the Libra float and say 95 Libra are minted.

The minting 🌱/ burning 🔥 story

The standard stablecoin logic is always centered around minting 🌱 and burning 🔥. As we will see, this is more of a theoretical micro-setting than what is bound to happen in practice. And this is not the part of the equation that explains Facebook’s larger-scale balance sheet game .

Here’s what will happen to the 100$:

On the user side, for new Libra coins to be created, there must be an equivalent purchase of Libra for fiat and transfer of that fiat to the reserve. Hence, the reserve will grow as users’ demand for Libra increases. In short, on both the investor and user side, there is only one way to create more Libra — by purchasing more Libra for fiat and growing the reserve.’ — Libra

This is accounting 101: the purchase of 95 Libra for 100$ creates a liability for the Libra association in the amount of 100$ and Libra’s cash reserves are in turn increased by 100$. I call the Libra Association’s liability side the “mint 🌱 and burn 🔥 factory”. But ‘minting’ and ‘burning’ is actually just some hip crypto parlance for creating and settling accounts payables. 😆

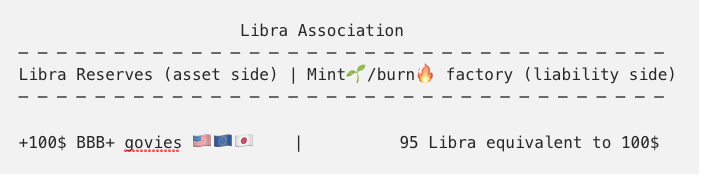

So what happens then? Obviously it would be a shame to just store the 100$ under the Silicon Valley consortium’s (Casper?) mattresses. 🛌 So instead, little piggy goes to the market and buys itself some low-yielding government and corporate bonds:

Users of Libra do not receive a return from the reserve. The reserve will be invested in low-risk assets that will yield interest over time. — Libra

So this what the Libra Association will look like after the govies and the BBB+ corporate bonds have been purchased:

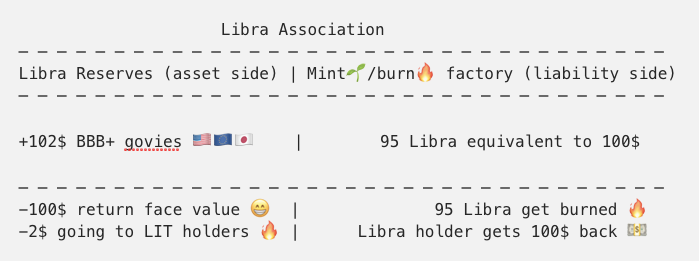

Now we come to the theoretical burning 🔥 part. I say ‘theoretical’, because it’s highly unlikely that Libra will actually mint and burn liquidity all the time.

Let’s say the BBB+ govies have returned 2% interest in the meantime and the currency basket hasn’t fluctuated. Then the 95 Libra will get burned, the fiat amount will be returned to the Libra HODLer and the 2$ in interest return will go to the Libra (LIT) governance token holders.

This is how it works in theory. But it would be totally inefficient to operate a large-scale stablecoin system like this, as constantly buying and selling low-yielding bonds would eventually erode the collateral (hello fixed-income bid-ask spreads).

The much more likely scenario is that Facebook and the other Libra partners will park their liquidity in the Libra foundation and then sell their Libra stashes as “authorized resellers”.

The reason we know this, is that we have a really close equivalent to what Facebook is proposing in the established financial markets: the so-called money market funds (MMFs).

‘Breaking the Zuck Buck ‘

What are MMFs? Money market funds are a $5+ trillion fixture in modern financial markets. They are collective investment schemes that invest in short-term high credit quality debt instruments. The balance sheet of the Libra Association will look a whole lot like your typical money market fund: low-yielding govies on the asset side, short-term liabilities on the other side.

Like a stable global currency, money market funds are treated a lot like ‘money’ from the institutional investor perspective (banks, pension funds, etc.) who buy them to manage their liquidity. Until the global financial crisis in 2008, they have never ‘broken the buck’, meaning that their value never fell below 1$. So they are quintessentially ‘stable’ ⚖️, much like the Libra aspires to be.

This similarity of Libra to money market funds is also why the Financial Times ran a series of rather provocative articles last week called ‘Breaking the Zuck Buck’ in which it was seeking:

‘to show how nonsensical, pointless, stupid, risky, badly thought-out and blockchainless the whole thing is.’ — FT Alphaville

So much for British ‘stiff upper lipping’ Libra. 👄😆 But the money market fund analogy is ‘spot on’ imho…

I’m a bit more optimistic than the FT though. I think that if you look at the reason why money market funds never ‘broke the buck’, then you’ll come to find that fund sponsors basically ‘staked’ their reputation. This is the same reason why I think Facebook could actually make this thing fly. 🚀

This Bank of International Settlement (BIS) research piece highlights the crucial role of fund sponsors’ willingness to calm the markets:

The reason why MMFs did not “break the buck” in 30 years, with one exception in 1994, is that fund sponsors have provided financial support when the market value of a share threatened to fall substantially below $1. While there is no legal obligation to provide support, fund sponsors have done so to preserve their business franchise. — BIS Quarterly Review

In my opinion, the equivalent to the fund sponsor’s in the Libra ecosystem will be the Libra association and in particular the Libra Resellers (of which Facebook will probably be the largest). Much like the large banks and mutual fund providers, who were managing the money market funds and didn’t want to let the MMFs ‘break the buck’, I believe Facebook will leverage the full force of its balance sheet to support the stability of the Libra. 💪

But first we need to understand what an ‘authorized Libra reseller’ is? This is how Libra puts it:

How Do Entities Interact With the Reserve?

Users will not directly interface with the reserve. Rather, to support higher efficiency, there will be authorized resellers who will be the only entities authorized by the association to transact large amounts of fiat and Libra in and out of the reserve. — Libra

So as I said above, it wouldn’t make any sense to keep selling and buying govies and BBB+ corporate bonds anytime liquidity comes into and out of the Libra system from consumers. So ‘to support higher efficiency’, Facebook will probably:

- In a first step ‘pre-mint’ a large portion of Libra, meaning it will park some of its $40bn+ cash liquidity in the Libra association (remember, it will get some pro-rata interest on this 💸, which i expect to be be proportional to vendor wallet usage/contribution). This means, it effectively doesn’t have to go to the “mint 🌱 and burn 🔥 factory” described above. Instead, the currency reserves are minted 🌱 once and then held in Libra for a while.

- In a second step, Facebook will then let its users get into Libra by selling from its own Libra stash and by buying up Libra when users want to get out of it. This will probably be through the FB balance sheet and not through the Libra Association’s balance sheet.

The cool thing for Facebook is that every time it sells (or rather originates) a dollar unit in Libra, it’s basically pushing an equivalent amount of its idle cash reserves off its balance sheet. But at the same time, Facebook gets fresh consumer liquidity onto its balance. These are not deposits (!), so it can invest these fresh funds as they like.

This is how the FT describes the role of the reseller:

‘Libra will use a network of authorised resellers (a.k.a its version of the authorised participant/primary dealer) to manage the creation and redemption of Libra currency in line with customer demand.’ — FT Alphaville

The Financial Times then points to a potential shortcoming of this Libra reseller system:

‘But it is unclear if the special arrangements will commit them to making markets even when liquidity conditions are poor.’ — FT Alphaville

This is where I believe, Facebook may positively surprise us at roll-out. Much like the MMF fund sponsors weren’t legally obliged to guarantee the MMF liquidity, they did so to ‘preserve their business franchise’. In other words, with the launch of the Libra, Facebook has just staked its brand value and reputation to act as market-maker.

Of course, stability and system resilience will all be a question of scale: let’s say Facebook mints Libra with its entire $40bn cash reserves, sells them to the public and then puts all of the fiat it receives into high-risk illiquid projects. In this scenario, the Libra project could run into difficulties, as the $40bn Libra holders would suddenly be faced with an illiquid Libra reseller. Or in other words: a defaulting market maker.

But as long as the Libra project and Libra supply stays small enough relative to Facebook’s and the Libra Association’s balance sheet, providing liquidity will be a non-issue. We would have Friedrich Hayek’s denationalized money and Facebook and the other tech giants have found a pretty elegant solution to park their excess cash reserves.

The regulatory hack

We haven’t touched the regulatory side so far. But there is also a pretty nice ‘regulatory hack’ associated with pre-minting the Libra with cash reserves and then selling them. The Financial Times notes:

Calibra is the only part of the organization seeking to be licensed, and the license it is going for is only a money transmission license. This is odd given the system’s ETF-like structure and grander deposit taking aspirations. — FT Alphaville

If Facebook would be qualified as taking deposits, it would obviously need to apply for a bank license in every country it wants to serve/take deposits. Similarly, if the Libra tokens would be deemed mutual fund shares or other forms of securities, this would obviously trigger registration requirements from the SEC and other authorities. As a result, Facebook, as an authorized reseller, would require a broker-dealer license from the SEC.

But at this point, it looks like Facebook plans to roll the whole Libra project out with nothing but a couple of FinCEN money transmitter licensesfor Calibra. 😵

Bold move…bold move.🤠

The logic works something like this: Facebook implicitly says: “We buy and sell stablecoin tokens. These are not securities! And when consumers put money into the system, we sell stablecoins, we don’t take consumer deposit.”

The legal claim that the stablecoins give the coin holders is vis-a-vis a non-profit Swiss foundation, the Libra Association, not Facebook or any other Libra member. These stablecoins also don’t pay any interest, so no reasonable expectation of profits under the Howey test 🍋👨🏻🌾. This means that they are (fingers crossed) not qualified as securities and Facebook does not have to register as a broker dealer.

In my opinion, there’s a big question mark, whether this legal structure will actually fly with regulators. 🤔

And Facebook doesn’t seem to be too sure about this either:

‘we are committed to working with authorities to shape a regulatory environment that encourages technological innovation’

As the Financial Times points out:

Openly stating the intent is “to shape a regulatory environment” rather than comply with the existing regulatory environment is a veiled assertion that Facebook is more powerful than the state, and that regulators should have to buckle to its will.

Well, I wouldn’t go so far as the FT to say that Facebook thinks its more powerful than the state, but the phrasing ‘intent to shape a regulatory environment’ certainly points to some level of uncertainty that the current rough regulatory draft will be accepted by regulators ‘as is’.

RIP ‘fat protocol theory’? ⚰️

This last bit is something we haven’t discussed so far: why is Facebook so uniquely positioned to push this ‘cryptocurrency’ out?

Duh…obviously because it owns the application layer of social. And if successful, Libra will most likely further ramp up engagement ‘on platform’ and allow Facebook to entrench itself deeper and deeper with all kinds of real-world vendors (remember, insta is morphing into an ecommerce platform). It’s the ‘WeChat of the West’ story that the Barclays analyst is talking about.

But that’s not even the point I’m trying to make here. My point is a bit more meta and probably most interesting to a handful of crypto VCs and investors out there. That’s why I’ve saved it for last.

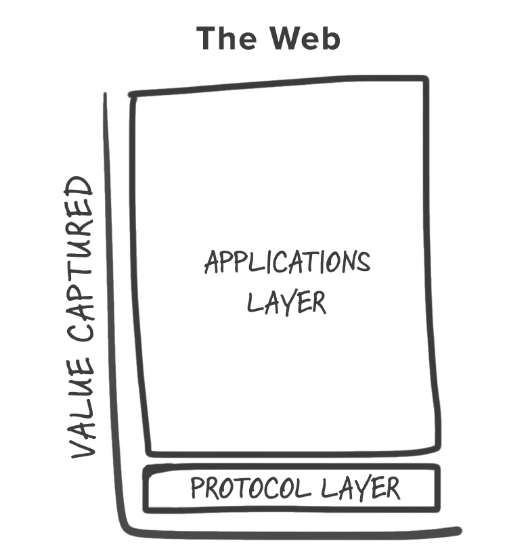

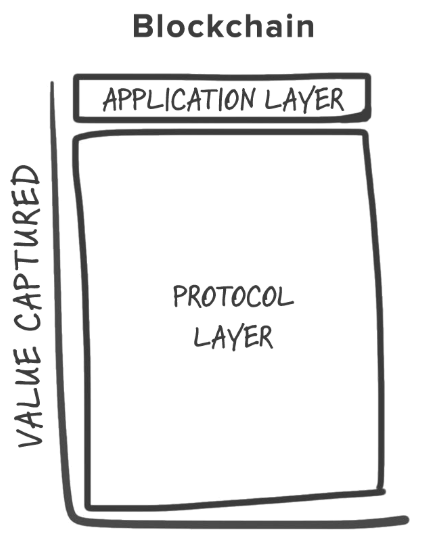

In the crypto-sphere, especially on the crypto VC side, there has emerged a commonly held theory over the last few years. This theory involves that in crypto, most of the value created will accrue at the protocol layer. This so-called ‘fat protocol theory’ was conceived by Joel Monégro in 2016 while still at USV and detailed in this famous post.

There are two nice and simple graphs that condense this theory, the first one shows were most of the value accrued in Web 2.0, namely at the application layer (aka FAANG).

He then goes on to compare it with where most value accrues in the blockchain space:

This seemed pretty cool to us crypto nerds out there for a while: cryptographic protocols are where the money is at! 💸 Cheerful cryptographic protocol engineers, mathematicians and distributed systems specialists all around. 🎉 This was their moment to shine. 🤓 As much as I personally loved the spirit of the fat protocol theory 😍, I was personally always quite skeptical of whether and how this would actually pan out.

And I was definitely skeptical about it from the moment I heard on Laura’s Unchained Podcast how Joel actually came up with this theory:

So that came about after actually looking at our Coinbase investment back when I was at USV and what I did is I looked at every time that we had put money in Coinbase and then went back and looked at the price of Bitcoin at those times and calculated what it would look like if we had instead bought bitcoin and bitcoin turned out to be a better investment. And, that was kind of the genesis observation of that thesis. — Joel Monégro

Comparing the Coinbase return with the Bitcoin price didn’t really strike me like a solid foundation for a generalizable theory.🤔 To be fair, I don’t think Joel ever intended for it to become a generalizable theory in the first place, but VCs investing in the crypto vertical have certainly taken to it like the bees to honey.🍯🐝

In particular, I always asked myself, how can the protocol layer capture more value without any mass adoption application layer? Isn’t a mass adoption application layer needed to distributes the protocol layer?

In many ways, the Libra project can be seen as a consortium of application layer companies creating their own protocol (LibraBFT), which it will distribute through its proprietary closed applications. If adoption of Libra becomes anywhere as substantial as regulators and central banks around the world think (or rather fear), than I think we might have to put the ‘fat protocol theory’ to rest (at least for now).

Conclusion

I’m personally excited to see the Silicon Valley heavyweights move into the space, but at the same time the media coverage Libra very much reminded my John Oliver’s description of cryptocurrencies:

It’s everything you don’t understand about money combined with everything you don’t understand about computers — John Oliver

Add to this everything you don’t understand about privacy and balance sheets and you’ve got Libra ≋.

That’s it for today.

Ttyl,

Erasmus

Self-plug: I also do voice recordings of these posts and smaller news snippets and scoops in my newsletter, check it out if you want to get looped in.