Most venture capital and private equity funds have a “recycling” provision in their limited partnership agreements (LPAs). Outside of the small circles of GPs, LPs and fund lawyers, this is not a very well-known set of rules that govern the flow of capital within a fund.

Put simply, recycling gives funds one or even a few “extra shots on goal”, as they can re-invest money on early exits. This can end up making the difference between a top quartile and a top decile fund (but also the other way around, if you’re not the type to use your extra shots wisely). In the base case, recycling capital provides a performance boost and is particularly important for emerging fund managers. This is because smaller sub-scale fund managers are notoriously under-reserved, meaning they don’t put aside enough cash to double down on portfolio winners, which often “pop up” only later in the fund lifecycle.

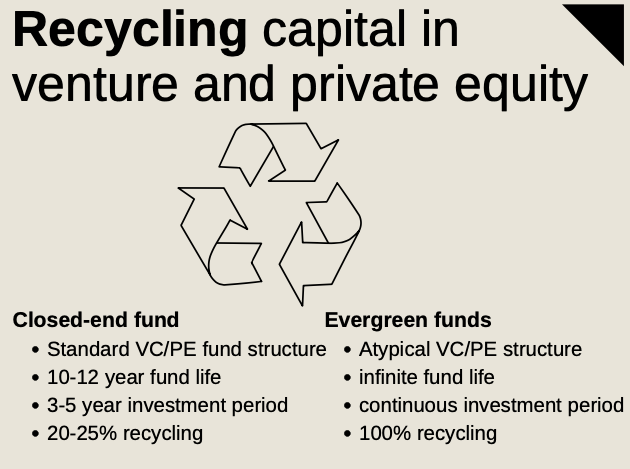

To get some intuition around this topic, let us start out with the basic logic of recycling. If you think about private market fund structures, you can think about the two extreme ends of the spectrum, first, the industry standard closed-end fund structure and the more “exotic” evergreen fund structure (where money flows like water, in and out of the evergreen vehicle, making the world and investors greener in the process).

The closed-end fund structureis the industry norm in venture and private equity. As investors do not want their money locked up in illiquid assets forever, all good things have to come to an end at one point. In the world of venture and PE, this means 10–12 years overall: the first few years for initial portfolio construction (“planting the seed stage”, typically lasting 3–5 years) with the remainder of the fund lifecycle dedicated to follow-on funding rounds and portfolio harvesting.

Things look different for evergreen fund structures. They are “ there to stay”, meaning they have an infinite fund life. Whenever an investment is realized, it just puts more “moolah in the coolah” and the pots keeps growing. All proceeds are re-invested, so “100% recycling” if you like.

Here’s why you should care

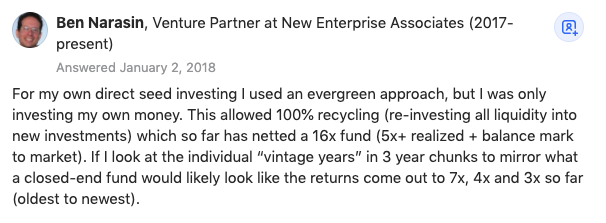

The Quora answer of Ben Nasarin from NEA above implicitly makes a larger point about recycling, namely that the extensive practice of recycling capital can make the difference between a 16x gMOIC fund (the equivalent of Michael Jordan’s No. 23 years) and a 3x gMOIC fund (more like Michael Jordan’s No. 45 years). In other words, it can help you re-slice and dice the same track record to where it turns from off-the-charts to just spectacular.

The reason for this is simple: if you start out with a small evergreen fund, say a $10m private vehicle, and you fully re-invest the 3x harvesting proceeds 5–6 years laters (say $30m) at the same money multiple, the gMOIC on the $10m committed capital will easily beat most traditional closed-end fund vintages with a regular 3 year investment period. Simply through the power of recycling and compounding.

In this line thought, as the recycling allowance of closed-end funds is increased significantly above industry norms (i.e. >25%), a closed-end fund is gradually sliding towards the evergreen structure economics, which can push fund performance significantly above vintage benchmark returns (more so on a money multiple basis, as recycling can actually be a drag on a time-weighted IRR basis). As a result, many GPs have become more aggressive in their use of recycling over the past years.

Getting from a $100m of committed capital fund to a $100m deployed

It is important to realise that with the standard 2/20 venture fund economics, if you want to get a $100 million fund that charges a 2% management fee and a 20% carry to full deployment, you need to recycle at least the “management fee load”, which typically adds up to 15–20% over the lifecycle of the fund. In other words, if $15m to $20m gets paid out in management fees, that would leave only $80m to $85m to invest in companies. So without recycling, there’s simply no full deployment. 15–20% of committed capital might look like a minor allocation, but these few extra shots (often made in overtime, see below) can be just what you need when you’re trying to hit 3x or more on a fund. Fred Wilson from USV has spoken about his firm’s recycling practice publicly before:

“We do this at USV very aggressively. It allows us to put the entire fund to work and recoup the management fee load. A $100mm venture capital fund will pay something like $20mm in management fees over a ten-year life. So it would only actually invest $80mm into startups. But if that fund recycled $20mm back into new investments, it could put the entire $100mm to work even after paying the $20mm in management fees. “— Fred Wilson

What and when to recycle

The recycling VC has to be smart like a fox, always coagulating between “getting married to a position” and “cashing out too early ”. The standard case for recycling is that you have a few early 1–3x pops in the portfolio, often talent acquisitions or acqui-hire situations. The more difficult decisions you have to make as an early-stage fund are around the big winners. There you have to decide whether to ride the rocketship to exit or take some money off the table early, e.g. through Series C+ growth capital/crossover fund secondaries (think Tiger, Vista, ICONIQ). If you take some chips off the table, you may be able to recycle it into new opportunities with a higher underwriting case. As Fred Wilson puts it:

“It can also make sense to take a little money off the table on a rocket ship type investment and recycle that. But doing too much of that sort of thing can reduce the returns in a fund instead of amplifying them.” — Fred Wilson

Hitting the extra shots in regular time

When it comes to actually hitting those extra shots, things can become more tricky and varied among funds. However, most funds only allow recycling capital during the 3–5 year investment period. Thus, say you’re in year 4 of a 5 year investment period and you have placed all your initial bets. Suddenly you get 2x back on an early acqui-hire exit. If there is no successor yet and you have a concrete deal in the pipeline, you can recycle the early exit proceeds into that additional fund investment. This would be the base case for recycling.

Hitting the extra shots in overtime

However, this being said, many LPAs also allow for follow-on funding of existing portfolio companies (pro-rata and above) after the initial investment period. If the recycling cap is not time-limited, e.g. capped at 20–25% over the entire lifetime of the fund, then later follow-on rounds can also be served with recycled distributions. This is an important nuance that can be easily lost and which can make the real performance difference, for a number of reasons:

- The likelihood of recyclable distributions is higher as the fund matures, significantly so after the 3–5y investment period;

- The ability to allocate recycled capital to follow-on opportunities means this capital is allocated to the potential double-down on portfolio winners;

- Many emerging manger under-reserve for follow-on financings and are thus often forced into cross-fund investments (which LPs hate), so the ability to recycle provides a welcome fund appendix.

Thus, being able to hit those extra shots with recycled capital in follow-on investments, can provide an essential return uplift.

Recycling bottom line

Fund recycling is an essential tool, not just for the new crop of ESG-centric VCs, but for every gMOIC-conscious GP out there looking for that “extra oomph” in net TVPI. Thus, just like those overtime extra shots, incorporating recycling in your fund model and LPA is a subtle fund flex no modern day GP should miss.